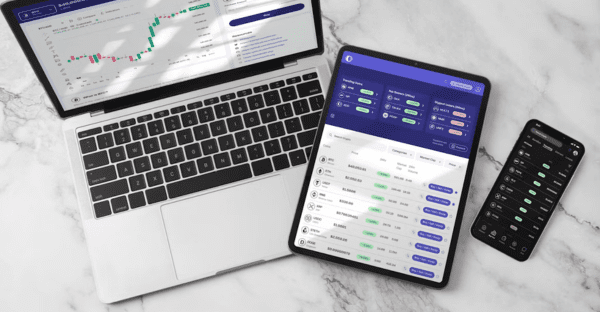

The way people manage their finances is changing—and fast. With the rise of artificial intelligence, automation, and user-friendly platforms, digital financial planning tools are transforming how individuals engage with their money. For financial planners and self-directed investors alike, these tools offer a new level of insight, accessibility, and control.

What Are Digital Financial Planning Tools?

Digital financial planning tools are software platforms or apps that help individuals manage their money more effectively. They range from simple budgeting apps to sophisticated platforms that offer investment tracking, retirement forecasting, and personalised financial advice.

These tools are designed to:

- Simplify complex financial data

- Provide real-time insights

- Help users set and track financial goals

- Support better decision-making

Why Digital Tools Are Gaining Traction

The shift toward digital financial planning is being driven by several key factors:

Accessibility

Digital tools are available 24/7, allowing users to manage their finances on their own schedule. This is especially valuable for busy professionals or those who prefer to self-manage their financial plans.

Personalisation

Many platforms use AI and machine learning to tailor recommendations based on a user’s income, spending habits, goals, and risk tolerance. This level of customisation was once only available through one-on-one financial advice.

Transparency

Interactive dashboards and visualisations make it easier to understand where your money is going, how your investments are performing, and whether you’re on track to meet your goals.

Cost Efficiency

Digital tools often come at a lower cost than traditional financial advisory services, making them accessible to a broader audience.

Examples of Tools in Use

In Ireland, the Competition and Consumer Protection Commission (CCPC) offers a free Budget Planner that helps users track income and expenses, identify savings opportunities, and plan for future costs. It’s a simple but powerful example of how digital tools can support financial literacy and planning

Other tools on the market include:

- Robo-advisors: Automated platforms that manage investments based on user-defined goals and risk profiles.

- Goal-based planning apps: Tools that help users save for specific milestones like a home deposit, education, or retirement.

- Cash flow trackers: Apps that categorise spending and highlight trends to improve budgeting.

How Financial Planners Are Using Digital Tools

Far from replacing human advisers, digital tools are enhancing the services financial planners provide. Many professionals now use these platforms to:

- Collaborate with clients in real time

Model different financial scenarios

Provide more frequent and data-driven updates

Streamline onboarding and reporting processes

This hybrid approach—combining digital tools with expert advice—offers the best of both worlds: efficiency and personalisation.

What to Consider When Choosing a Tool

Not all digital financial planning tools are created equal. When evaluating options, consider:

- Security: Look for platforms with strong encryption and data protection policies.

Integration: Choose tools that sync with your bank accounts, pension providers, and investment platforms.

User experience: A clean, intuitive interface makes it easier to stay engaged and informed.

Support: Some tools offer access to human advisers or customer service for more complex needs.

Conclusion

Digital financial planning tools are reshaping how people interact with their finances. Whether you’re just starting out or looking to optimise an existing strategy, these tools can offer clarity and control. But technology is only part of the picture.

At LHK, we believe that smart financial planning combines the best of digital innovation with trusted, personalised advice. Our experienced advisers are here to help you navigate your financial journey—whether that means choosing the right tools, planning for retirement, protecting your family, or growing your wealth. Learn more here.

Get in touch today to speak with an LHK adviser and explore how we can support your financial goals—digitally and beyond.